NEW YORK, NY, May 8, 2025 — Morgan Stanley Direct Lending Fund (NYSE: MSDL) (“MSDL” or the “Company”), a business development company externally managed by MS Capital Partners Adviser Inc. (the “Adviser”), today announced its financial results for the first quarter ended March 31, 2025.

QUARTERLY HIGHLIGHTS

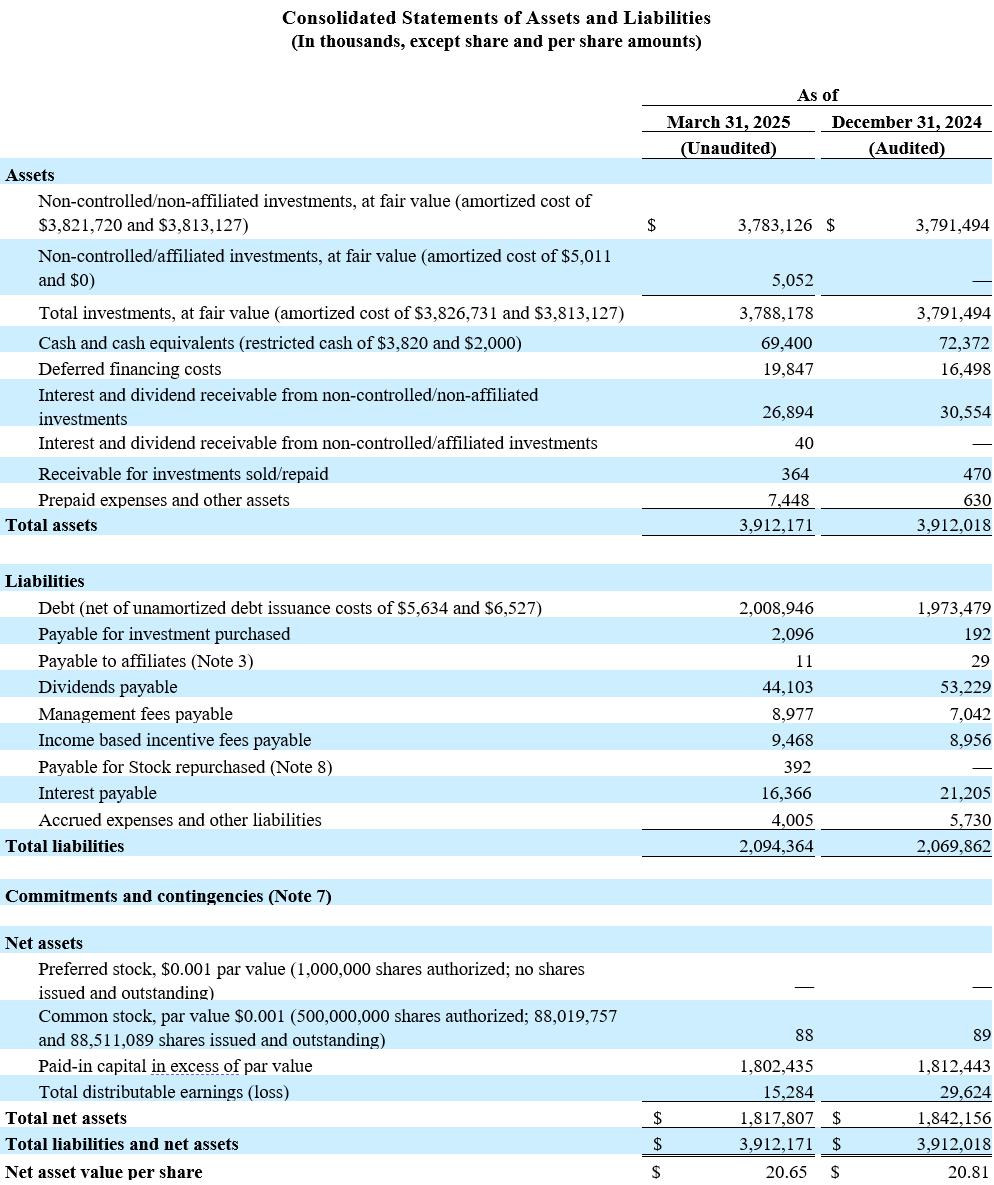

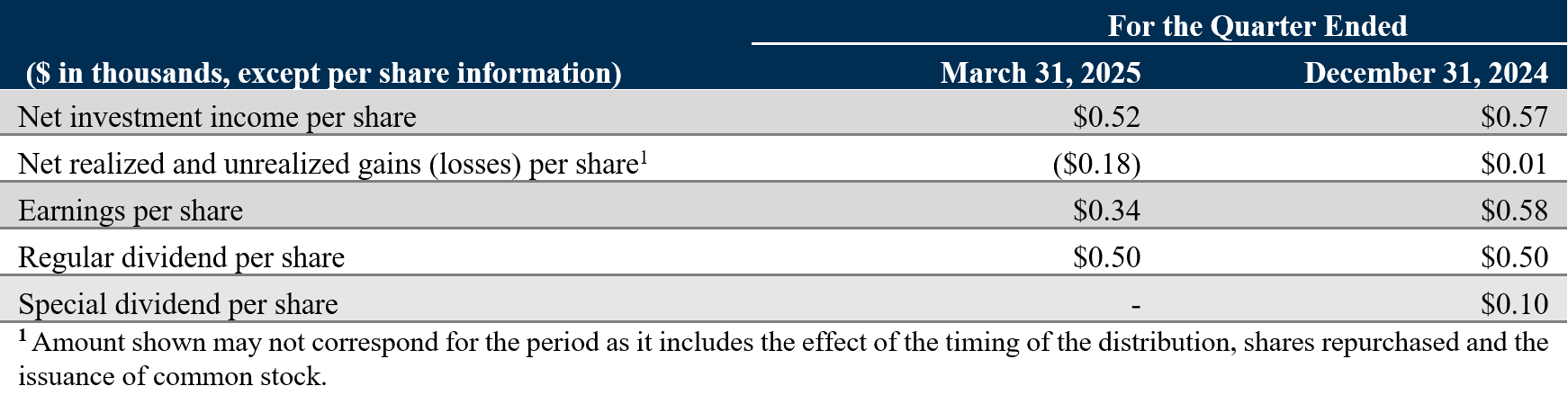

- Net investment income of $46.2 million, or $0.52 per share, as compared to $50.7 million, or $0.57 per share, for the quarter ended December 31, 2024;

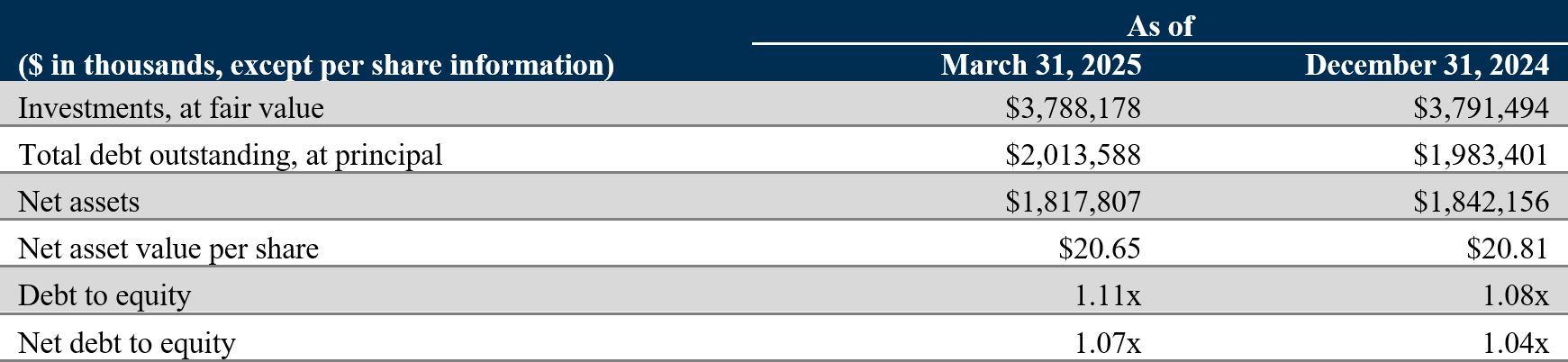

- Net asset value of $20.65 per share, as compared to $20.81 as of December 31, 2024;

- Debt-to-equity was 1.11x as of March 31, 2025, as compared to 1.08x as of December 31, 2024;

- New investment commitments of $233.4 million, fundings of $205.6 million and sales and repayments of $201.8 million, resulting in net funded deployment of $3.8 million;

- The Company’s Board of Directors (the “Board”) declared a regular dividend of $0.50 per share to shareholders of record as of March 31, 2025; and

- The Company established an at-the-market offering (“ATM”) through which the Company may sell shares of its common stock, having an aggregate offering price of up to $300.0 million.

SELECTED FINANCIAL HIGHLIGHTS

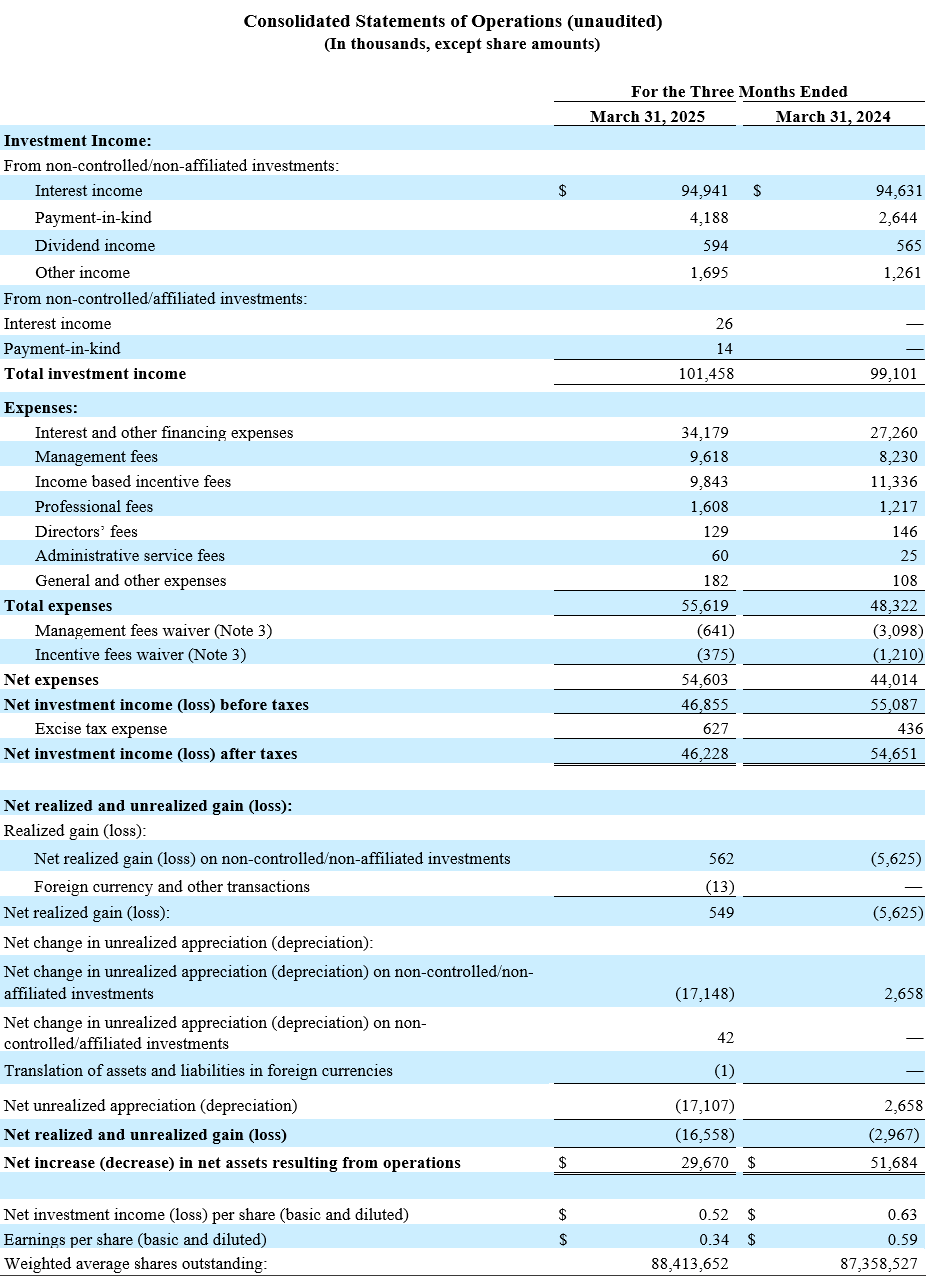

RESULTS OF OPERATIONS

Total investment income for the quarter ended March 31, 2025 was $101.5 million, compared to $103.0 million for the quarter ended December 31, 2024. The decrease was primarily driven by lower base rates, partially offset by higher repayment related income as compared to the prior period.

Total net expenses for the quarter ended March 31, 2025 were $55.2 million, compared to $52.3 million for the quarter ended December 31, 2024. The increase in net expenses quarter over quarter was primarily attributable to higher net management and income based incentive fees incurred following the expiration of the Adviser’s waiver of a portion of the base management and incentive fees in connection with the Company’s initial public offering.

Net investment income for the quarter ended March 31, 2025 was $46.2 million, or $0.52 per share, compared to $50.7 million, or $0.57 per share, for the quarter ended December 31, 2024.

For the quarter ended March 31, 2025, net change in unrealized depreciation on investments was $17.1 million, partially offset by net realized gains of $0.5 million.

PORTFOLIO AND INVESTMENT ACTIVITY

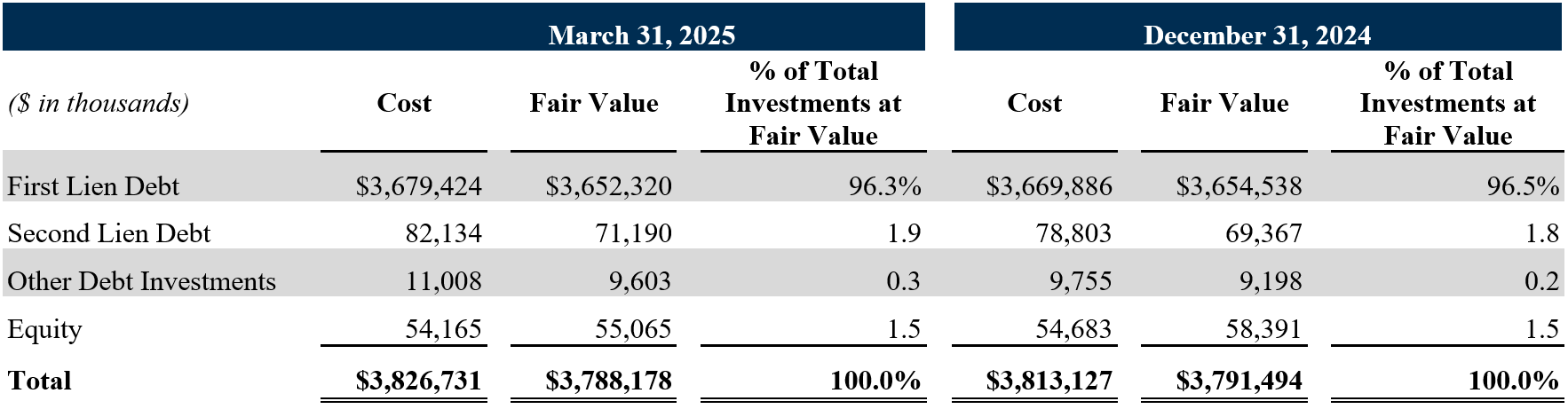

As of March 31, 2025, the Company’s investment portfolio had a fair value of approximately $3.8 billion, comprised of 210 portfolio companies across 34 industries, with an average investment size of $18.0 million, or 0.5% of our total portfolio on a fair value basis. The composition of the Company’s investments was the following:

Investment activity was as follows:

Total weighted average yield of investments in debt securities at amortized cost and fair value was 10.2% and 10.3%, respectively, as of March 31, 2025, compared to 10.4% and 10.5%, respectively, as of December 31, 2024. Floating rate debt investments as a percentage of total portfolio on a fair value basis was 99.6% as of March 31, 2025, unchanged compared to December 31, 2024. As of March 31, 2025, certain investments in two portfolio companies were on non-accrual status, representing approximately 0.2% of total investments at amortized cost.

CAPITAL AND LIQUIDITY

As of March 31, 2025, the Company had total principal debt outstanding of $2,013.6 million, including $316.0 million outstanding in the Company’s BNP funding facility, $647.6 million outstanding in the Company’s Truist credit facility, $275.0 million outstanding in the Company’s senior unsecured notes due September 2025, $425.0 million outstanding in the Company’s senior unsecured notes due February 2027 and $350.0 million outstanding in the Company’s senior unsecured notes due May 2029. On February 25, 2025, the Company executed an amendment to the Truist Credit Facility, extending the maturity to February 2030, increasing the total commitment to $1.45 billion and lowering the spread to 1.775%. The combined weighted average interest rate on debt outstanding was 6.11% for the quarter ended March 31, 2025. As of March 31, 2025, the Company had $1,084.1 million of availability under its credit facilities and $65.6 million in unrestricted cash. Debt to equity was 1.11x and 1.08x as of March 31, 2025 and December 31, 2024, respectively.

SHARE REPURCHASES

In January 2024, the Company authorized a share repurchase program to acquire up to $100.0 million in the aggregate of the Company’s common stock at prices below net asset value. On February 27, 2025, the Board authorized an amended and restated share repurchase program, which has a maximum size of $100.0 million, exclusive of prior repurchases. For the three months ended March 31, 2025, the Company repurchased 491,332 shares at an average price of $20.38 per share.

ATM OFFERING

On March 28, 2025, the Company entered into equity distribution agreements pursuant to which the Company may sell shares of the Company’s common stock having an aggregate offering price of up to $300.0 million.

For the three months ended March 31, 2025 there were no shares issued through the ATM offering.

OTHER DEVELOPMENTS

- On May 8, 2025, the Board declared a regular distribution of $0.50 per share, which is payable on July 25, 2025 to shareholders of record as of June 30, 2025.

CONFERENCE CALL INFORMATION

Morgan Stanley Direct Lending Fund will host a conference call on Friday, May 9, 2025 at 10:00 am ET to review its financial results and conduct a question-and-answer session. All interested parties are invited to participate in the live earnings conference call by using the following dial-in numbers or audio webcast link available on the MSDL Investor Relations website:

- Audio Webcast

- Conference Call

- Domestic: 323-994-2093

- International: 888-254-3590

- Passcode: 221038

To avoid potential delays, please join at least 10 minutes prior to the start of the earnings call. An archived replay will also be available on the MSDL Investor Relations website.

About Morgan Stanley Direct Lending Fund

Morgan Stanley Direct Lending Fund (NYSE: MSDL) is a non-diversified, externally managed specialty finance company focused on lending to middle-market companies. MSDL has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. MSDL is externally managed by MS Capital Partners Adviser Inc., an indirect, wholly owned subsidiary of Morgan Stanley. MSDL is not a subsidiary of or consolidated with Morgan Stanley. For more information about Morgan Stanley Direct Lending Fund, please visit www.msdl.com.

Forward-Looking Statements

Statements included herein or on the webcast/conference call may constitute “forward-looking statements,” which relate to future events or MSDL’s future performance or financial condition. These statements are not guarantees of future performance, condition or results and involve a number of risks and uncertainties. Actual results and conditions may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in MSDL’s filings with the U.S. Securities and Exchange Commission. MSDL undertakes no duty to update any forward-looking statements made herein or on the webcast/conference call.

Contacts

Investors |

Media Alyson Barnes 212-762-0514 alyson.barnes@morganstanley.com |